About Us

We Help Our Clients To Grow Their Assets

Founded with a vision to simplify wealth creation, AAAG Wealth Management Pvt. Ltd. is built on decades of financial expertise, ethical practices, and client-first values. From guiding families in their early investment journeys to helping professionals and businesses grow their portfolios, we are committed to making wealth management simple, transparent, and effective.

Our Mission

To empower individuals and families with disciplined investment strategies, research-backed decisions, and personalized advice, ensuring sustainable long-term growth.

No Hidden Cost

Transparent process, clear fees, no hidden charges alwaysDedicated Team

Experienced professionals committed to your financial growth24/7 Available

Always accessible, anytime you need our support.10% -20%

Average Portfolio Growth10 Cr

Total Wealth Managed95%

Advisory Accuracy28

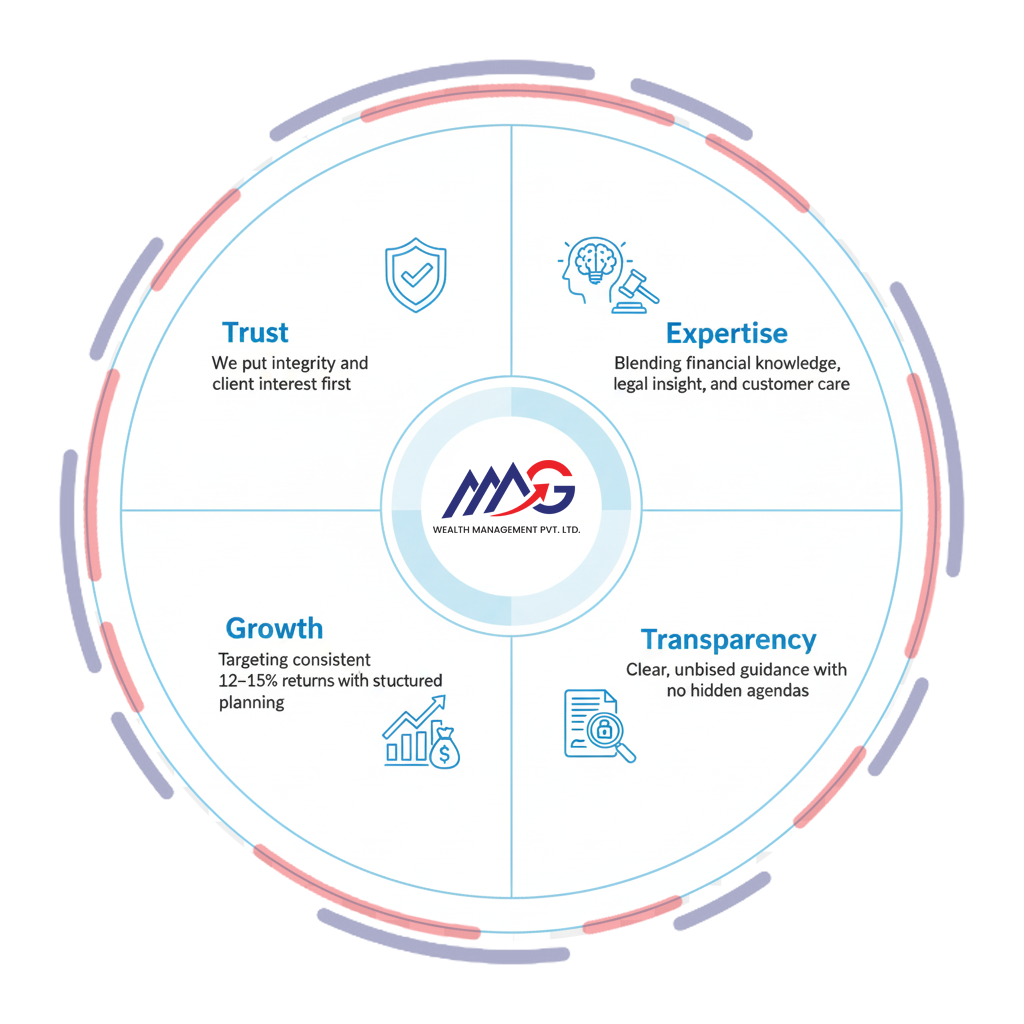

Awards AchievedOur Values

Few Reasons Why People Choosing Us!

Trust We always uphold integrity. Our clients’ interests come first in everything we do

Expertise We always uphold integrity. Our clients’ interests come first in everything we do

Transparency We provide clear, unbiased guidance. There are no hidden agendas in what we do

Growth Targeting consistent 12–15% returns with structured planning

Our Services

Awesome Financial Services For You

Mutual Fund Distribution (AMFI Licensed)

We are authorized distributors of mutual funds, licensed by AMFI. Our consultants help you:

Align investments with your life goals

Diversify portfolios for steady returns

Aim for consistent 12–15% growth with disciplined planning

Our role is to simplify mutual fund investing so you can focus on your goals, while we take care of research, compliance, and execution.

Know More

Share Trading with Motilal Oswal Franchise

As an authorized franchise of Motilal Oswal,one of India’s most respected financial institutions, we provide:

Access to a world-class trading platform

Research-based recommendations to guide decisions

Reliable execution and personalized advisory support

Whether you are a beginner or an active trader, our partnership with Motilal Oswal gives you the edge of professional expertise.

Know More

💎 Portfolio Management Services (PMS)

PMS: Bespoke Wealth Management for Discerning Investors

For high-net-worth individuals and those with complex financial requirements, we offer Portfolio Management Services (PMS), providing direct, dedicated management of your investments. Our PMS team helps you:

🔒 Achieve True Customization: Receive a portfolio explicitly designed around your unique risk profile, liquidity needs, and specific financial goals, unlike standardized mutual funds.

🧠 Access High-Conviction Research: Benefit from the active, high-touch management of an expert portfolio manager and a dedicated research team, aiming for superior risk-adjusted returns.

📈 Maintain Transparency & Control: Own the individual securities directly in your Demat account, with full transparency on every transaction and regular, detailed performance reporting.

Our role is to serve as your dedicated financial command center, providing specialized investment strategies and making real-time, discretionary decisions to actively grow and protect your substantial wealth.

Know More

We help you make the most of systematic investment options designed for consistency, flexibility, and financial balance. Our consultants help you:

Build long-term wealth through disciplined Systematic Investment Plans (SIPs)

Optimize returns and manage risk with Systematic Transfer Plans (STPs)

Enjoy regular income without disturbing capital growth through Systematic Withdrawal Plans (SWPs)

Our role is to structure these plans in alignment with your financial goals—ensuring liquidity, stability, and growth through every stage of your wealth journey.

Know MoreOur Team

Leadership Team

ALEX KUNJU KUNJU – Managing Director

ANILA ALEX – Managing Director

GEETHU SARAH ALEX – Marketing Head

JENI SALU – Manager and Customer support

ANJANA J R – Customer Relation

News and Events

Latest Happenings

Smart Investing: SIPs and Mutual Funds Continue to Drive Steady Wealth Growth

The latest market trends reaffirm the power of Systematic Investment Plans (SIPs) and mutual funds in long-term wealth creation. A recent study revealed that consistent SIP investors could turn small monthly contributions into substantial wealth, highlighting the benefits of disciplined investing. Meanwhile, SEBI’s proposal for performance-li...

What SIP, STP and SWP Investors Should Know

Mutual-fund houses are increasingly promoting flexible options such as “Top-up SIP”, “Pause SIP”, STP and SWP to match changing investor needs. One article summarises: “From SIPs, Top-up, Pause, STP to SWP: Five mutual-fund tools every smart investor should use.” At the same time, regulatory changes from Se...

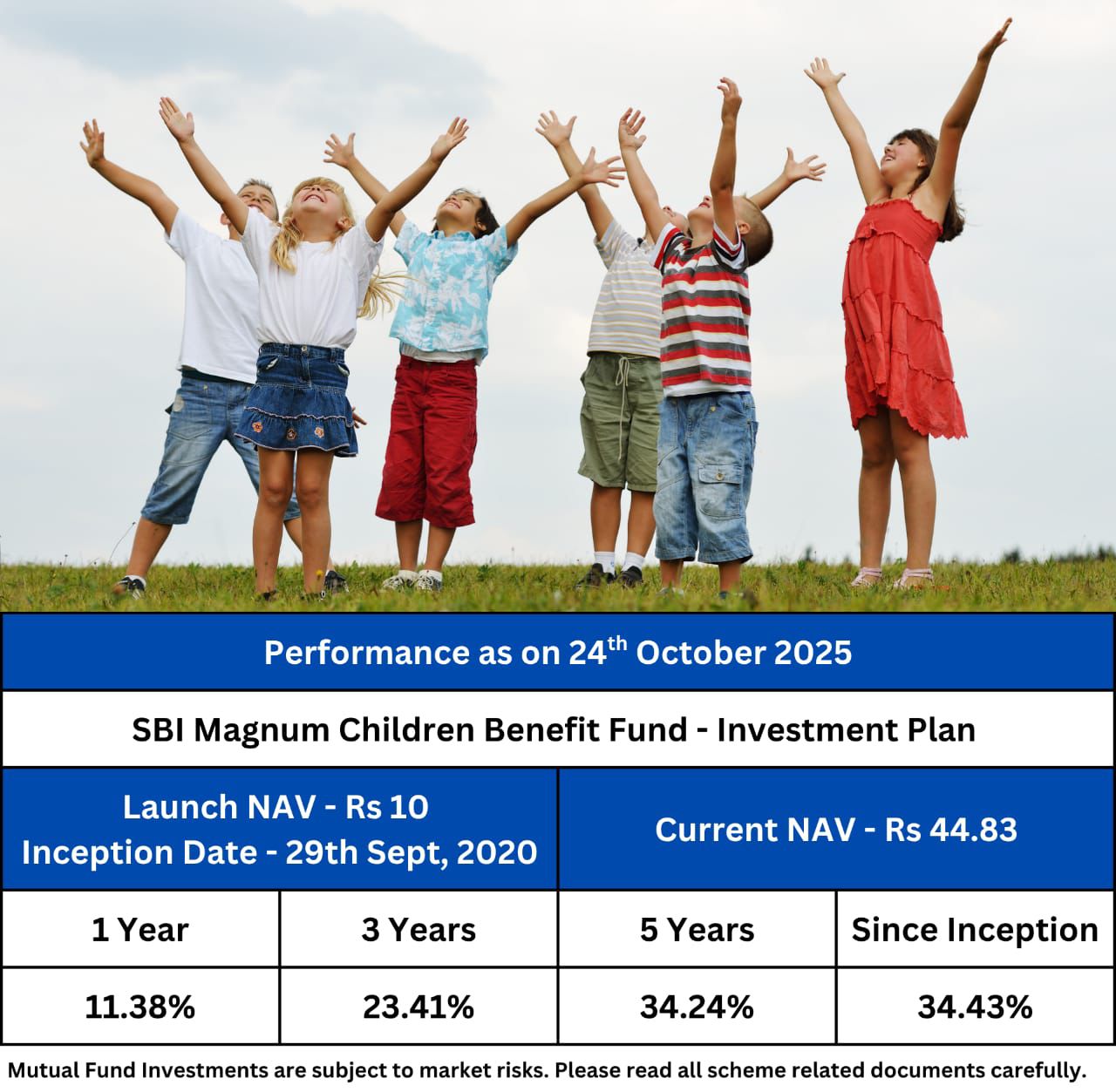

Secure Your Child’s Future with SBI Magnum Children’s Benefit Fund

Planning your child’s financial future starts today. The SBI Magnum Children’s Benefit Fund – Investment Plan has shown impressive growth, with returns of 11.38% in 1 year, 23.41% over 3 years, and 34.24% in 5 years, since its launch in September 2020. With a current NAV of ₹44.83, this fund is ideal for parents seeking long-ter...

Testimonial

What Our Clients Say!

Jack Ben Vincent

Business Owner

Sibi Augustine

Business Owner

Mr. Rajkumar

DM – LIC of India

Mr. Jayakumar

Chief Town Planner (Retired)Get In Touch